Tax Planning

Tax Planning: A Comprehensive Overview

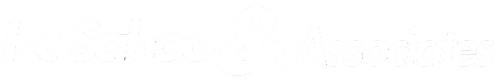

Tax planning is a crucial part of personal and business financial management. It involves analyzing your financial situation and making strategic decisions to legally minimize your tax liability while aligning with your broader financial goals.

🧠 What is Tax Planning?

Tax planning is the process of organizing your finances in such a way that you can take full advantage of the various deductions, exemptions, allowances, and rebates permitted by law to reduce your tax burden.

🎯 Objectives of Tax Planning

✅ Minimize Tax Liability – Reduce the amount of tax payable through legal means.

💼 Ensure Compliance – Meet all legal requirements and avoid penalties or scrutiny.

📈 Optimize Investments – Choose tax-saving instruments that also help grow wealth.

🛡️ Increase Savings – Retain more of your earnings for future use.

🧾 Efficient Resource Utilization – Allocate resources wisely with tax impact in mind.

📚 Types of Tax Planning

| Type | Description |

|---|---|

| Short-term Tax Planning | Planning for a financial year to minimize tax liability without long-term commitments. |

| Long-term Tax Planning | Planning well in advance with long-term tax-saving investments like PPF, ELSS, etc. |

| Permissive Tax Planning | Using methods allowed by law (e.g., Section 80C deductions). |

| Purposive Tax Planning | Planning with specific financial objectives in mind (e.g., retirement, education). |

🧾 Key Tax Planning Strategies (India-specific, but concepts apply broadly)

👨👩👧👦 For Individuals

Utilize Section 80C (Up to ₹1.5 lakh)

PPF (Public Provident Fund)

ELSS (Equity-Linked Savings Scheme)

Tax-saving FDs (5-year)

LIC premiums

Home loan principal repayment

Additional Deductions

Section 80D – Health insurance premiums

Section 24(b) – Home loan interest (up to ₹2 lakh)

Section 80G – Donations to charities

Section 80E – Education loan interest

Invest in Tax-free Instruments

PPF

Sukanya Samriddhi Yojana

Municipal bonds (in some countries)

Choose the Right Tax Regime

Old regime (with deductions) vs. New regime (lower tax rates, no deductions)

🏢 For Businesses

Depreciation on assets

Business expenses (travel, rent, salaries, etc.)

Carry forward losses

Investment in R&D and other tax-incentivized sectors

HUF (Hindu Undivided Family) structuring (India-specific)

💡 Tips for Effective Tax Planning

Start early in the financial year (avoid March rush)

Maintain records of all investments and expenses

Use digital tools or consult a tax advisor

Review tax law updates every year

Combine tax planning with financial planning for goals like retirement, education, etc.

🧮 Example: Tax Planning Scenario (India)

Suppose your annual income is ₹10,00,000. Here’s a possible tax-saving plan:

| Investment / Expense | Deduction Claimed |

|---|---|

| PPF contribution | ₹50,000 |

| ELSS investment | ₹50,000 |

| Life insurance premium | ₹25,000 |

| Health insurance premium (80D) | ₹25,000 |

| Home loan interest (Section 24b) | ₹2,00,000 |

| Total Deduction | ₹3,50,000 |

This reduces your taxable income significantly, lowering your tax outgo.

🧠 Conclusion

Tax planning is not about evading taxes—it’s about being smart, proactive, and compliant. By understanding the tax laws and using the available provisions wisely, you can legally reduce your tax burden, improve your cash flow, and achieve your financial goals faster.

Don't Suffer in Silence, Let Us Help You Get The Justice You Deserve!

Contact us now for a free consultation