Tax Compliance and Filing

kcsahooandassociates01@gmail.com

September 17, 2025

GST Registration: Everything You Need to Know

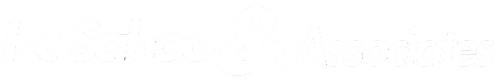

📝 What is Tax Compliance?

Tax compliance means following all rules, laws, and procedures laid down by the government regarding the payment and reporting of taxes. It ensures that taxpayers—individuals, businesses, and organizations—accurately declare income, pay taxes on time, and file returns as required.

Non-compliance can lead to penalties, interest, and even legal consequences.

🔑 Key Aspects of Tax Compliance

PAN & Aadhaar Linking

Permanent Account Number (PAN) is mandatory for filing taxes.

Aadhaar must be linked to PAN for seamless processing.

Maintaining Proper Records

Salary slips, bank statements, investment proofs, loan documents, and TDS certificates (Form 16/16A).

Advance Tax Payments

For taxpayers with income beyond salary, taxes must be paid in installments during the financial year.

TDS & TCS Compliance

Ensure that Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are properly deducted/collected and deposited with the government.

GST (for businesses)

Businesses must comply with Goods and Services Tax (GST) regulations, file GST returns, and pay dues on time.

📥 Filing of Income Tax Return (ITR)

Who Needs to File?

Individuals with income above the basic exemption limit.

Businesses, firms, companies, and associations.

Anyone wanting to claim a refund of excess TDS.

ITR Forms

ITR-1: Salaried individuals (income up to ₹50 lakh).

ITR-2: Individuals/HUFs with capital gains or foreign income.

ITR-3: Individuals with business/professional income.

ITR-4: Presumptive taxation (small businesses/professionals).

ITR-5, ITR-6, ITR-7: For firms, LLPs, companies, and trusts.

Steps to File

Register/Login to the Income Tax e-filing portal.

Choose the correct ITR form.

Fill in income details, deductions, and tax paid.

Verify with Aadhaar OTP, Net Banking, or Digital Signature.

Submit and download the acknowledgment (ITR-V).

Deadlines

Individuals (without audit): July 31 of the assessment year.

Businesses requiring audit: October 31.

⚖️ Why Tax Compliance & Filing Matter

✅ Legal responsibility under the Income Tax Act.

✅ Avoid penalties, interest, and legal action.

✅ Build financial credibility (loans, credit score, visas).

✅ Access tax refunds and benefits.

✅ Contribute to national development.

✨ In short: Tax compliance and timely filing are not just obligations—they’re essential for financial discipline, smooth business operations, and contributing to economic growth.

✨ Remember: Tax compliance = Peace of mind + Financial credibility + Nation building.

Don't Suffer in Silence, Let Us Help You Get The Justice You Deserve!

Contact us now for a free consultation