Balance Sheet

kcsahooandassociates01@gmail.com

September 20, 2025

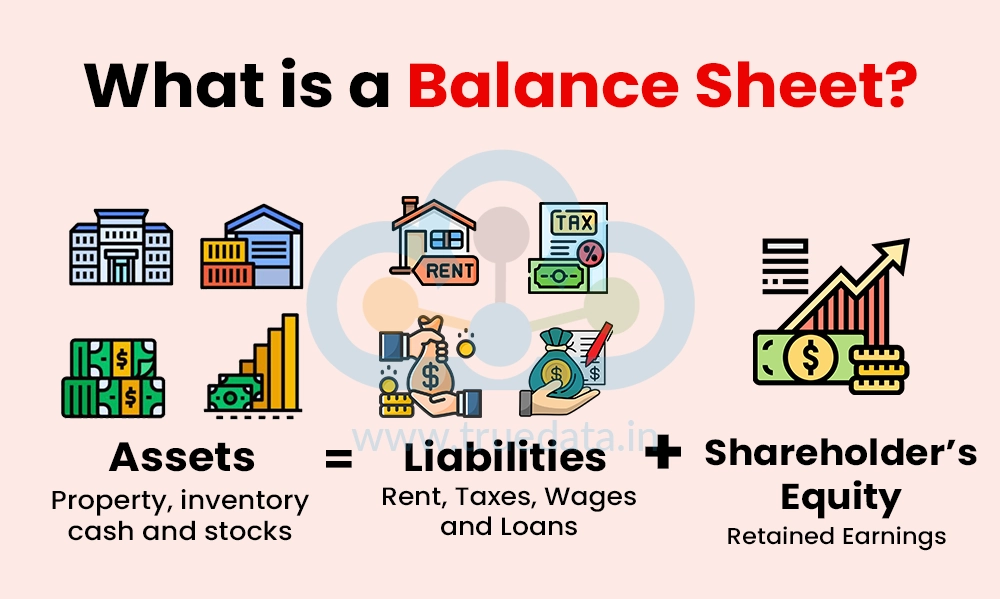

The Balance Sheet Blueprint: What Your Business Owns, Owes & Is Worth.

🏠 Understanding the Balance Sheet: Your Business is Like a House

Imagine your business as a house. To understand its financial health, you take a snapshot on a specific date — like a photo of everything you own, owe, and what’s truly yours.

Just like a house inspection, we freeze everything on this day to check your financial picture.

🧱 PARTS OF YOUR HOUSE (Balance Sheet)

1. ASSETS = What Your House Owns

Think of these as your stuff — things you own that have value.

| 🧰 Assets | 💰 Amount |

|---|---|

| 💵 Cash on Hand | ₹50,000 |

| 📦 Inventory (Stock) | ₹30,000 |

| 🏢 Building | ₹40,000 |

| Total Assets | ₹1,20,000 |

2. LIABILITIES = What Your House Owes

These are obligations — debts to outsiders, like loans or bills.

| 🧾 Liabilities | 💰 Amount |

|---|---|

| 🏦 Loan from Bank | ₹40,000 |

| 🧍♂️ Creditors (Unpaid Suppliers) | ₹20,000 |

3. OWNER’S EQUITY = Your Share in the House

What’s truly yours after paying off what you owe.

| 🧑💼 Owner’s Equity | 💰 Amount |

|---|---|

| 🏠 Owner’s Capital | ₹60,000 |

🔑 Key Formula

Assets = Liabilities + Owner’s Equity

₹1,20,000 = ₹60,000 (Equity) + ₹60,000 (Liabilities)

It balances, just like a well-built house! 🏡

🎯 Real-Life Example:

If you sold everything (assets) for ₹1,20,000, you’d use ₹60,000 to pay off debts (liabilities), and the remaining ₹60,000 would be yours — your equity!

✅ WHY IT MATTERS?

Helps investors see if your business is healthy.

Shows how much debt vs. ownership is in the business.

Used for planning, loans, and growth decisions.

📌 Final Tip:

A balance sheet is not about profit — it’s about POSITION.

It shows where your business stands, not how much money it’s making.

Don't Suffer in Silence, Let Us Help You Get The Justice You Deserve!

Contact us now for a free consultation